Nigeria’s $20 billion real estate market offers 10–15% returns, but many think you need millions to start (source: Nigeria Property Centre, 2025). Wrong! With just ₦50,000, you can dip your toes into property investments, thanks to REITs, crowdfunding, and proptech. Whether you’re a student in Enugu or a diaspora Nigerian in London, 2025 is your year to build wealth.

This Investing guide shares 5 ways to start investing in Nigerian real estate with ₦50,000 in 2025, with platforms, costs, and tips. Perfect for beginners, it’s your roadmap to financial growth.

Table of Contents

- Real Estate Investment Trusts (REITs)

- Crowdfunding Micro-Investments

- Fractional Ownership Shares

- Land Co-Ownership Plans

- Short-Let Investment Pools

- How to Kickstart Your Investment

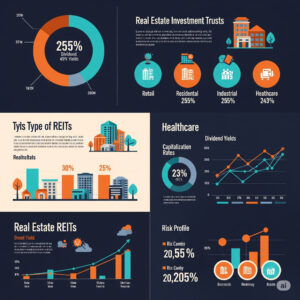

1. Real Estate Investment Trusts (REITs)

Cost: ₦50,000–₦200,000

Why It Works: REITs pool funds to buy properties, paying 8–12% dividends. No property management needed!

Platform: Skyline REIT on Nigerian Exchange (ngxgroup.com, ₦50,000 minimum).

Example: Temi, a Lagos student, invested ₦50,000 in Skyline REIT, earning ₦5,000/year.

Tip: Use brokers like ARM Securities (₦3,000 fee). Check SEC registration (sec.gov.ng).

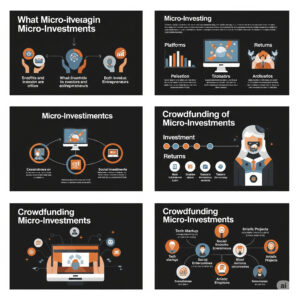

2. Crowdfunding Micro-Investments

Cost: ₦50,000–₦100,000

Why It Works: Fund new developments for 10–15% returns in 12–24 months.

Platform: Crowdx (crowdx.ng, ₦50,000 entry).

Example: Kemi, a diaspora Nigerian, crowdfunded ₦50,000 for an Abuja estate, earning ₦7,500 after 18 months.

Tip: Choose projects with clear timelines. Verify with SEC (₦5,000).

Cross-Link: Learn market trends in our opinions piece.

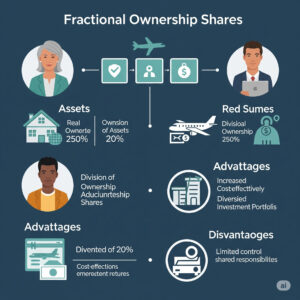

3. Fractional Ownership Shares

Cost: ₦50,000–₦500,000

Why It Works: Own a tiny share of rental properties, earning 8–10% rental income.

Platform: Wealth.ng (wealth.ng, ₦50,000 minimum).

Example: Chidi, a Port Harcourt teacher, bought a ₦50,000 share in a Lekki flat, earning ₦4,000/year.

Tip: Use proptech platforms for transparency (see our proptech guide).

4. Land Co-Ownership Plans

Cost: ₦50,000–₦200,000

Why It Works: Co-own plots in emerging areas like Ibeju-Lekki for 20–30% appreciation in 3 years.

Platform: LandWey (landwey.ng, ₦50,000 entry).

Example: Aisha, an Enugu freelancer, co-owned a ₦50,000 Epe plot share, now worth ₦65,000 after 2 years.

Tip: Verify titles with ESVARBON (₦30,000).

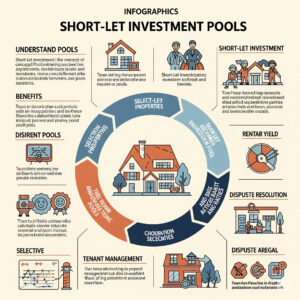

5. Short-Let Investment Pools

Cost: ₦50,000–₦300,000

Why It Works: Fund short-let properties (e.g., Airbnb) in Lagos or Calabar for 12–15% ROI.

Platform: Spleet (spleet.africa, ₦50,000 minimum).

Example: Emeka, a VI bartender, invested ₦50,000 in a VI short-let pool, earning ₦6,000/year.

Tip: Target tourist hubs like Calabar (see our travel guide).

6. How to Kickstart Your Investment

- Set a Budget: Start with ₦50,000–₦100,000.

- Choose Platforms: Use SEC-registered sites like Crowdx or Spleet (₦3,000–₦5,000 fees).

- Verify Legals: Check with ESVARBON or SEC (₦30,000–₦50,000).

- Diversify: Spread ₦50,000 across REITs and crowdfunding for safety.

Build Wealth with ₦50,000

Nigeria’s real estate market is booming, and you don’t need millions to join. This Investing guide shows how ₦50,000 can kickstart your journey in 2025. Share it to inspire others!

Share This Post: Post on LinkedIn, X, WhatsApp, Instagram, or TikTok to spread the investment vibe! 💰

Subscribe to Nigeria Real Estate Blog for more investing tips, proptech insights, and travel guides!

GIPHY App Key not set. Please check settings